Author’s note:

OP Innovate is not equipped to provide assistance to individuals affected by the scam. The article’s purpose is to raise awareness and expose the fraudulent scheme. Please note that OP Innovate does not handle specific cases or offer direct support for such incidents.

Executive Summary:

The EVJORERJG app, launched on July 12, 2024, under the guise of a legitimate financial platform, is a sophisticated cryptocurrency scam designed to defraud users through a combination of deceptive trading practices and security vulnerabilities. Developed by AmrSaad, the app entices victims with promises of easy profits in cryptocurrency trading, offering a demo mode that simulates high returns. Once users are convinced of its legitimacy, they are encouraged to deposit real money, which is swiftly transferred to wallets controlled by the scammers.

Key tactics include:

- Demo Mode Illusion: Simulating successful trades to falsely build user confidence.

- Real Fund Deposits: Encouraging users to invest real money based on their demo success.

- Withdrawal Blocks: Preventing users from withdrawing funds through technical barriers or fabricated fees.

- TRC-20 USDT Exploitation: Using the TRC-20 blockchain for low-fee, irreversible transactions, making stolen funds unrecoverable.

The app’s malicious activities extend beyond simple fraud. It exploits users by gaining excessive device permissions, potentially compromising personal data and security. Security vulnerabilities include improper encryption, raw SQL queries prone to injection attacks, and the use of insecure random number generators.

This research, conducted by Bar Refael and Ben Brauner, highlights the growing trend of financial scams masquerading as legitimate apps, emphasizing the need for vigilance and better regulatory oversight. Users are urged to carefully vet financial apps and beware of platforms promising high returns with little risk. The EVJORERJG scam serves as a stark reminder of the dangers in the unregulated cryptocurrency trading space.

Breakdown of the Scam Process

The fraudulent operations of EVJORERJG are meticulously crafted, employing well-established methods frequently used in the financial scam ecosystem. Here’s how the scam typically unfolds:

- Initial Contact via Telegram:

- Method: The scam begins when the victim receives a direct message on Telegram, often appearing to be an accidental message from a business-related account.

- Persona Creation: The scammer adopts a persona likely to be well-received by the target, such as a young, attractive individual or a financial expert.

- Building Rapport: Through flattery and friendly, emotionally engaging language, the scammer builds a false sense of trust and connection with the victim.

- Demo Mode Illusion:

- The victim is introduced to the EVJORERJG app, specifically to its demo mode, where they engage in what they believe are real-time cryptocurrency or financial trades.

- This simulated environment shows consistently high profits, convincing the victim that they are capable of making significant gains once they transition to real-money trading.

- The demo mode is designed to appeal to novice traders or individuals new to cryptocurrency, encouraging them to believe they can replicate the results with actual investments.

- Encouraging Monetary Deposits:

- After convincing the victim of potential profits, the scammer persuades them to deposit real money into the app. Users are told that by investing real capital, they can surpass the returns seen in demo mode.

- The app continues to simulate successful trades using these real funds, deepening the victim’s trust in the app.

- In reality, these “trades” are fabricated, and the deposited funds are never engaged in actual financial transactions.

- Transition to Real Investment:

- The victim believes they are making real investments, but in truth, they are transferring cryptocurrency into wallets controlled by the scammer.

- The victim’s EVJORERJG app account merely shows a representation of the cryptocurrency, but the actual funds have already been moved to the scammer’s wallet.

- Withdrawal Blocks and Additional Fees:

- When the victim attempts to withdraw funds, they are met with various barriers such as pending statuses or vague technical issues preventing the release of their earnings.

- As withdrawal requests escalate, the victim may be asked to pay additional fees for “taxes” or other fabricated charges to release the funds.

- In some cases, users are told they have violated international laws, which leads to the “freezing” of their funds, further complicating the situation.

- Legal Threats and Final Extraction:

- As part of the scam, the victim is made to believe they have violated cross-border financial regulations or laws. They are threatened with legal action unless they pay more money.

- The scammer introduces a fake “crypto bank” that claims hold the victim’s funds due to the legal issue. The only way to regain access, they say, is by paying more money.

- All the cryptocurrency that the victim has paid is, by this point, in the scammer’s possession, with no real chance of recovery.

For a more detailed analysis of the application platform, please refer to Appendix 1.

How Scammers Leverage TRC-20 in Fraud

In the deceptive practices of cryptocurrency scams, scammers often manipulate victims into believing that the scammer’s wallet is actually the victim’s own wallet. This tactic is particularly insidious as it plays on the victim’s trust and lack of understanding of how cryptocurrency transactions work. For example, a scammer may provide the victim with a wallet address under the guise that it belongs to them, encouraging the victim to view any incoming or outgoing transactions as their own. In reality, the wallet is controlled entirely by the scammer.

This misrepresentation allows the scammer to request funds under various pretenses, assuring victims that they are merely transferring money to their own wallet for security, investment, or verification purposes. Once the funds are transferred to the scammer’s actual wallet, they quickly move them to different addresses or exchange them for other currencies, thereby laundering the money and obscuring the trail. Victims may only realize the deception when they attempt to withdraw or use their supposed funds and find that they have no actual control over the wallet provided by the scammer. Such tactics highlight the need for heightened vigilance and a deep understanding of transaction processes in cryptocurrency dealings.

How Scammers Exploit TRC-20 in Cryptocurrency Frauds Scammers often manipulate victims by requesting payments in cryptocurrencies like USDT via the TRC-20 network, which is favored for its minimal transaction fees and high speed. In a noted case, a victim shared on Reddit that they were duped into sending funds to a scammer’s wallet, thinking it was his own. The wallet address involved in this deceit was TW2WpspF9hBQU7cw8e7uEAaSVFXkBFPoUZ. Once the funds are transferred, scammers swiftly relocate or exchange the cryptocurrencies, rendering them almost untraceable and irrecoverable. This method showcases the sophisticated tactics employed in digital fraud, emphasizing the critical need for vigilance in cryptocurrency transactions.

For a more detailed analysis of the “Key Findings and Transaction Analysis of the Scam Wallet”, please refer to Appendix 2.

The Role of USDT TRC-20 in Crypto Scams

USDT (Tether) is a stable coin pegged to the value of the US dollar, commonly used for its liquidity and ease of transfer across different blockchains. The TRC-20 version operates on the TRON blockchain, making it a preferred choice for transactions due to its negligible fees and near-instantaneous confirmations. However, these features also make USDT-TRC20 an appealing tool for scammers.

In the Reddit user’s case, the scammer leveraged these advantages to swiftly and irreversibly steal funds, with no possibility of a chargeback or recovery once the transaction was completed.

Why Scammers Use USDT TRC-20

- Irreversibility: Blockchain transactions, once executed, cannot be reversed. Scammers rely on this to ensure victims have no way to retrieve their funds.

- Anonymity: Although blockchain transactions are publicly visible, wallet addresses typically do not reveal the identity of their owners, enabling scammers to remain anonymous.

- Speed: TRC-20 transactions are processed rapidly, making it difficult to stop or dispute a payment once initiated.

Red Flags in USDT TRC-20 Transactions

- Requests for USDT Transfers: Legitimate platforms usually offer multiple payment options and rarely insist on cryptocurrency, especially without providing a clear business justification.

- Anonymous Payment Addresses: If the recipient insists on payment via anonymous wallet addresses, it’s a strong indication of fraud.

- No KYC or Security Measures: Lack of Know Your Customer (KYC) or Anti-Money Laundering (AML) protocols is often a red flag in crypto-related transactions.

Protecting Yourself Against USDT TRC-20 Scams

- Double-Check Payment Requests: Always verify the legitimacy of anyone requesting payment, especially when cryptocurrency is the only option.

- Monitor Blockchain Transactions: Use blockchain explorers like TRONSCAN to check transaction histories, but keep in mind that this won’t recover funds once they’ve been sent.

- Avoid Pressure to Pay in Crypto: Scammers frequently create a sense of urgency to push victims into fast payments. Take your time to investigate the request thoroughly before making any transfers.

Associated Companies and the EVJORERJG Connection as mentioned in “TraderKnows”

In the shadowy corners of the cryptocurrency and financial trading world, several companies have surfaced, linked either directly or indirectly with the notorious application EVJORERJG, known for its fraudulent schemes. These connections underscore the breadth and depth of a network that exploits the burgeoning interest in financial tech innovations to orchestrate expansive scams.

List of Companies Associated with EVJORERJG:

- FBS (fbssltd.com): Known for claiming high returns on investments, FBS has faced scrutiny for misleading claims about its regulatory status and headquarters location.

- Aoc (aocfxs.com) and MSquare (msquaregold.com): Both companies feature prominently in discussions around fake regulatory claims and have designs and operational tactics that mirror known fraudulent patterns.

- XM Pro (aaaxmprofx.com) and XM Defi (aaaxmfx.com): These platforms are flagrant examples of firms that mimic legitimate trading services while facilitating dubious transactions under the guise of enhanced trading technology.

- Catalyst Markets Ltd (catalystmarketsltd.com): This entity, along with similar setups like Pershing Square Capital Management (pershingment.com) and BCG Markets (bcgmarkets.com), exhibits classic signs of fraudulent operations, including the absence of credible regulatory information and consistent customer complaints.

- AUS GLOBAL Textdiy (ausglobalforex.com) and UYS (uysltd.com): These firms are known for their opaque operations and have been flagged for potential regulatory infractions and unethical business practices.

- FOREXPro Markets Ltd (forexpro-fx.com) and Lbma Limited (lbmalimited.com): Both companies have been implicated in suspicious activities, with unclear fee structures and unverified claims about trading volumes and security.

- Vanine Limited (vanineltd.com) and XM Group FX (xmgroupfx.com): These entities are part of a larger network that often redirects users to high-risk or outright scammy trading platforms.

- Dukascopy (dukascopy.com) and AQR Trading Global Ltd (aqrtgltd.com): Although they present a facade of legitimacy, these companies have been cited in various user reports and risk assessments for questionable practices that align closely with those observed in EVJORERJG’s operations.

Implications of These Associations

The linkage of these companies to EVJORERJG raises significant concerns about the integrity and safety of investing through platforms that are part of this network. The repeated patterns observed—such as the use of misleading information, lack of clear regulatory adherence, and the exploitation of users’ trust—suggest a coordinated effort to target and defraud investors, particularly those new to the cryptocurrency and CFD markets.

Investors are urged to exercise extreme caution and perform thorough due diligence before engaging with any platform associated with these names. Regulatory bodies are also called upon to intensify their oversight and enforcement actions to protect consumers from these sophisticated fraud schemes.

Misuse of Trusted Brands and Communication Channels

- Foreign Bank Misuse:

- The app falsely claims affiliation with Dukascopy, a reputable Swiss bank, giving the appearance of legitimacy to inexperienced users.

- Gmail for Customer Support:

- Legitimate financial institutions typically use company-specific email addresses (e.g., support@companyname.com). EVJORERJG, however, employs Gmail for support—a red flag that signals its lack of professionalism and authenticity.

- Telegram for Communication:

- The scammers behind EVJORERJG rely heavily on Telegram for communication due to its anonymity. Unlike legitimate institutions that use official phone lines or secure in-app messaging, the use of Telegram enables the scammers to remain hidden.

Red Flags and Warning Signs

Several warning signs consistently emerge in user reviews and reports of EVJORERJG, including:

- Poor User Ratings: With a rating of 1.0 out of 5 stars from 33 reviews, EVJORERJG has one of the lowest ratings in the finance app category. Users commonly report significant financial losses and an inability to recover their funds.

- Anonymity of the Developer: The developer, AmrSaad, provides minimal verifiable information about their identity or background—an anonymity common among scam developers.

- Unrealistic Financial Promises: The app claims to deliver high returns with minimal risk, a hallmark of financial scams. Unlike legitimate platforms, it does not provide disclaimers about the risks involved in trading.

- Excessive Permissions: EVJORERJG requests access to personal data, network information, and the ability to modify files on the user’s device. These permissions can be exploited to monitor user activity or steal sensitive information.

Exploitation of Regulatory Bodies to Coerce Payments

A particularly insidious method used by fraudulent schemes like EVJORERJG involves mimicking communications from well-established regulatory authorities such as the Financial Conduct Authority (FCA). In this deceptive practice, scammers send messages via platforms like Telegram, falsely claiming they are from these authorities. These messages often inform the user that their financial activities have triggered cross-border restrictions and are under investigation for serious charges like money laundering.

In a typical scenario, the fraudulent message would assert that due to the user’s alleged involvement in suspicious activities, their account and funds are now subject to an extended investigation. This supposed investigation is described as necessary to comply with international laws and could last up to an extensive amount of time, during which the user’s funds would remain inaccessible. Here, the scammers leverage the authority of the FCA’s name, or FCA-like regulations companies) to create a veneer of legitimacy and urgency.

To intensify the pressure, the attackers then present the user with two options:

- Wait It Out: The user can choose to wait for the completion of the investigation, which the scammers claim will take a year, or so. This option is designed to appear unfavorable, pushing the user towards the second, more immediate resolution.

- Pay to Expedite: Alternatively, the user is offered the option to pay a significant sum of money to “release” themselves from the investigation and regain access to their funds quickly. This option preys on the user’s fear and impatience, as the sum requested is typically large and must be paid under the guise of clearing the regulatory hurdles promptly.

This tactic not only exploits the user’s trust in regulatory bodies but also manipulates their fear of legal trouble and financial insecurity. By presenting a high-stakes dilemma involving reputed legal authorities, the scammers aim to coerce users into making large payments to avoid supposed legal repercussions. It is a stark example of how sophisticated these fraudulent operations have become, utilizing psychological manipulation and the reputations of respected institutions to deceive users effectively.

Broader Implications: A Dangerous Trend in Finance Apps

EVJORERJG represents a growing trend in the finance app space, where scammers target users interested in cryptocurrency and online trading. These apps, often appearing professional and legitimate, use common communication channels like Telegram and Gmail to obscure their real identities and avoid direct scrutiny.

The app’s rapid rise in downloads—nearly 4,000 in a short period—demonstrates how effective its deceitful marketing strategies have been. However, as more users become aware of the scam, its downfall will likely be as swift as its initial success. Still, this case underscores the need for regulatory intervention to prevent similar scams from flourishing in the future.

How to Recognize and Avoid Such Scams

- Verify Identity and Source: Be cautious of unsolicited messages and verify the identity of individuals through multiple independent sources before engaging in any conversation related to financial investments.

- Research the Investment Platform: Thoroughly research any investment platform to ensure it is legitimate and properly regulated. Check for reviews, regulatory body endorsements, and its presence on official financial advisory lists.

- Understand Cryptocurrency Risks: Cryptocurrency transactions are irreversible and anonymous. Once sent, there is no way to reclaim funds if they are transferred under fraudulent pretenses.

- Be Wary of High Returns Promises: High returns with little or no risk are a classic sign of investment scams. Legitimate investments always involve some level of risk.

- Consult Financial Advisors: Before making any investment, especially involving large amounts of money or cryptocurrency, consult with a certified financial advisor or a trusted financial institution.

- Recognize Emotional Manipulation: Scammers often use emotional language or pressure tactics to compel action. Step back and reassess if you feel rushed or emotionally driven in making financial decisions.

Recommendations for Users and Regulatory Bodies

- For Users:

- Verify Identity and Source: Always verify the identity of individuals and platforms offering financial services.

- Research the Platform: Thoroughly research any financial app, focusing on reviews and regulatory compliance.

- Check the App’s Reputation: Avoid being an early user of untested apps. Look for well-established apps with a significant number of downloads and high ratings. If an app is new and doesn’t have many downloads, be cautious. For instance, Moovit has 100M+ downloads, while established financial apps like Poalim have 1M+. Comparing this with EVJORERJG’s low download count is a red flag.

- Understand Cryptocurrency Risks: Be aware that cryptocurrency transactions are irreversible and offer no recourse if transferred to fraudulent entities.

- Be Skeptical of High Returns: High returns with little to no risk are often a sign of scams.

- For Regulatory Bodies:

- Stricter Oversight: There is a pressing need for regulatory bodies to enforce stringent vetting processes for financial apps.

- Education and Awareness: Educating the public about the risks of digital financial services will help users make informed decisions.

Conclusion

The EVJORERJG app exemplifies the dangers posed by unregulated financial apps in the digital age. Despite its professional appearance, it is a carefully constructed scam designed to defraud its users. The misuse of trusted names like Dukascopy, along with generic communication methods such as Gmail and Telegram, adds layers of deception, making it difficult for users to realize they’ve been duped until it’s too late.

The consequences of such scams are broad and troubling, resulting not only in financial loss but also in the erosion of trust in legitimate financial applications. This erosion threatens the adoption of innovative financial technologies that could otherwise offer genuine benefits to users.

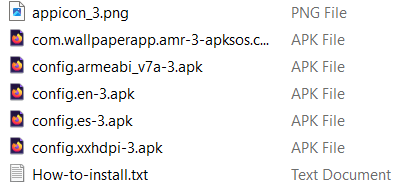

Appendix 1: Further information of “EVJORERJG” and Sandbox Analysis Summary

EVJORERJG 1.1.1 APKs

- Version: 1.1.1

- File size: 17.53MB

- Requires: Android 4.0+

- Package Name: com.wallpaperapp.amr

- Developer: AmrSaad

- Updated Jul 12, 2024

- Price: Free

- Rate 4.50 stars – based on 10 reviews

Related files:

com.wallpaperapp.amr_1.1.1_apkgk.com.zip Sandbox Analysis Summary:

Community Score

- 0 / 65: No security vendors flagged the file as malicious.

File Details

- File Size: 10.40 MB

Detected Behaviors

- Sets Process Name: Adjusts the name of a process it runs.

- Detects Debug Environment: Detects when it is being run in a debugging or analysis environment.

Security Findings

MITRE ATT&CK Tactics and Techniques

- Defense Evasion (TA0005):

- T1564: Hidden files and directories.

- T1564.001: Creates hidden files, links, and/or directories.

- Discovery (TA0007):

- T1518.001: Uses the “uname” system call to query kernel version information, possibly for evasion.

Network Communications

- No direct network communications were detected. Legitimate URLs found in memory patterns include:

- android.googlesource.com

- api.flutter.dev

- firebase.flutter.dev

- github.com

- www.unicode.org

File System Actions

- Extensive read and write actions were observed in system directories, particularly related to font and configuration files.

- Tools used: Linux utilities such as dbus-launch, engrampa, and 7z were employed for ZIP file handling.

App Overview

- File Name: com-wallpaperapp-amr1720756800.apk

- Package Name: com.wallpaperapp.amr

- App Name: EVJORERJG

- App Security Score: 56/100 (Medium Risk)

- Grade: B

- Target SDK: 33

- Min SDK: 23

- Version: 1.1.1

- Exported Activities: 2

- Exported Services: 1

- Exported Receivers: 1

Permissions (Potentially Dangerous)

- WRITE_EXTERNAL_STORAGE: Allows the app to modify external storage.

- READ_EXTERNAL_STORAGE: Allows the app to read from external storage.

- READ_MEDIA_IMAGES/VIDEO/USER_SELECTED: Permissions for reading media files.

- INTERNET: Grants full internet access.

- POST_NOTIFICATIONS: Allows the app to post notifications.

- ACCESS_NETWORK_STATE: Allows the app to view the network status.

- RECEIVE_BOOT_COMPLETED: Allows the app to start automatically at boot.

Security Vulnerabilities

- Janus Vulnerability: The app is signed with v1, v2, and v3 signature schemes, but may be vulnerable on Android 5.0-8.0 if only v1 is used.

- Exported Components: Multiple exported components (activities, services, receivers) are not well protected, leaving them accessible to other apps, which poses a potential security risk.

- SQL Injection Risk: The app uses raw SQL queries without proper input validation, making it vulnerable to SQL injection attacks.

- Insecure Random Number Generator: An insufficiently random number generator is used, which could compromise cryptographic security.

- Sensitive Data Logging: The app logs sensitive information, increasing the risk of exposing confidential data.

- Hardcoded Secrets: Hardcoded sensitive information, such as API keys and credentials, was found, which could be exploited.

File System and Network Actions

- SQLite Database: The app uses SQLite to store data, but without proper encryption, which increases the risk of data exposure.

- Access to External Storage: Data written to external storage could be read by other apps, making it vulnerable to unauthorized access.

- Clipboard Usage: The app copies data to the clipboard, which can be accessed by other apps, potentially exposing sensitive information.

Highlighted Security Concerns

- Backup Risk: The app allows backup of its data, which could expose sensitive information if the device is compromised.

- Random Number Generator: The app’s use of an insecure random number generator could lead to weak cryptographic security.

- SQL Injection Risk: Raw SQL queries without validation make the app susceptible to SQL injection attacks.

Network and Communication Risks

- The app accesses legitimate domains such as:

- play.google.com

- developer.android.com

- firebase

However, no indications of malicious external communication were observed during the analysis.

Appendix 2: Key Findings and Transaction Analysis of the Scam Wallet

1. Role as an Intermediary Wallet

The wallet appears to function as an intermediary, receiving large sums of USDT from known exchanges and promptly redistributing these funds to multiple untagged addresses. This pattern suggests the wallet is being used to:

- Aggregate Funds: Collect large amounts from various sources, possibly converting other cryptocurrencies to USDT.

- Disperse Funds: Quickly transfer the accumulated funds to other addresses, likely to obscure the trail and complicate tracking efforts.

- Implication: Acting as a hub, the wallet facilitates the movement of funds within the scam network, making it a critical point of investigation.

2. Significant Inflows from Exchanges

The wallet received substantial amounts from addresses associated with major exchanges, primarily OKEx and Gate.io:

- OKEx Deposits: Totaling approximately 17,953.872 USDT over several transactions.

- Example: On September 15, 2024, received 6,500 USDT (Transaction ID: 8d5b1065f5ba405bc57a8cca1fe7f670e40262a3712d57492c06909d30a5b76f).

- Gate.io Deposit: Received 203.08 USDT on September 16, 2024 (Transaction ID: 9b7b8cccef045bbc38d3ceb494f1f0f5f2eedd0e577c38962e1d2912f1712fea).

- Implication: The consistent inflow from exchanges suggests that the operators might have accounts with these platforms, potentially providing an avenue for identification through KYC information.

3. Large Outgoing Transfers to Unidentified Addresses

Significant amounts were sent to addresses without any known tags, including:

- 10,000 USDT to TFmqxXv63T1stJjHLRjXE2jPxuf2i5qBbB on September 11, 2024.

- 17,000 USDT to TJD6yhQLuuGKzrwcmsNKzHP4DxJzfuMDmb on September 17, 2024.

- 200 USDT to TLJzFxo1vwTPaDqgYEvfxMcoLFzC5UZXRL on September 24, 2024.

- Implication: The lack of identification for recipient addresses and the sizable amounts involved raise red flags about potential attempts to launder money or distribute proceeds from fraudulent activities.

4. Repeated Interactions with Specific Addresses

- Address TFmqxXv63T1stJjHLRjXE2jPxuf2i5qBbB: Received a total of 12,097 USDT over two transactions.

- Address TJD6yhQLuuGKzrwcmsNKzHP4DxJzfuMDmb: Received 17,000 USDT in a single transaction.

- Implication: These addresses may be key nodes in the scam network. Investigating them could uncover further connections and reveal the scope of the fraudulent operation.

5. Suspicious Small and Risky Transactions

Several transactions are marked as riskTransaction: true, involving minimal amounts. Examples include:

- 0.001156 USDT from TLRFLEcnbiQhXuSiK8ZFqh3DryR8888888 on September 10, 2024.

- 0.010001 USDT from TFmZ26uJ2QCRSSM6Y7wrnsxjfRubi5qBbB on September 11, 2024.

- 0.017001 USDT from TJDa6b1WVTnbxEn5gKqjatiBr2BoFuMDmb on September 17, 2024.

- Implication: These small, risky transactions could be test transfers to confirm wallet connectivity, avoid detection, or serve as markers for coordinating illicit activities.

6. Unusual Transaction Patterns

- A zero-value transferFrom transaction was initiated on September 24, 2024 (Transaction ID: 149ec0ac33186e60ac12c1b0ddd6be192fbf531820845d7b27e99e7734169d31).

- Immediately followed by a small transfer of 0.0201 USDT back to the wallet.

- Implication: Such patterns might indicate attempts to exploit smart contract functionalities, test vulnerabilities, or further obscure the transaction trail.

7. Indicators of Money Laundering Techniques

- Rapid Fund Movement: Quick succession of receiving and sending large amounts suggests layering strategies to disguise the origin of funds.

- Use of Multiple Platforms: Funds are funneled through various exchanges, adding complexity to tracking efforts.

- Implication: These are classic signs of money laundering, reinforcing the likelihood of the wallet’s involvement in illicit activities.

8. Potential Links to Larger Scam Operations

- Consistent Behavior Patterns: The wallet’s activity mirrors common tactics used in organized crypto scams, including:

- Consolidation of Funds: Gathering assets from different sources before disbursing them.

- Obfuscation of Transactions: Utilizing untagged addresses and small, inconspicuous transactions to hide the flow of funds.

- Network Connections: The repeated interactions with specific addresses could point to a broader network of wallets working in tandem.

- Implication: The wallet may be part of a larger, coordinated scam operation, and uncovering its connections could lead to significant breakthroughs.

Recommendations for Further Action

- Trace Recipient Addresses: Investigate the activities of addresses receiving large sums, focusing on transaction histories and potential links to known scams.

- Collaborate with Exchanges: Reach out to OKEx and Gate.io to request information on the accounts associated with the sending addresses, leveraging any available KYC data.

- Utilize Blockchain Analytics Tools: Employ tools like Chainalysis or Elliptic to map out the transaction network and identify patterns or clusters associated with fraudulent activities.

- Monitor for Ongoing Activity: Set up real-time alerts for transactions involving the suspect wallet and associated addresses to promptly detect further suspicious movements.

- Engage Law Enforcement: Share the findings with relevant authorities to initiate legal proceedings and potentially recover lost assets.

Final Thoughts

The evidence strongly suggests that the wallet TW2WpspF9hBQU7cw8e7uEAaSVFXkBFPoUZ is involved in a crypto scam, exhibiting multiple red flags:

- Large and frequent transfers from exchanges point to significant funding sources.

- Immediate and sizable outgoing transactions to untagged addresses indicate attempts to disperse and launder funds.

- Risky and unusual transaction behaviors raise concerns about the wallet’s activities and intentions.

By focusing investigative efforts on this wallet and its connections, there’s a substantial opportunity to disrupt the scam operation, identify the perpetrators, and potentially prevent further fraudulent activities.

Next Steps

- Deepen the Investigation: Conduct a more granular analysis of transaction timings, counterparties, and any metadata available.

- Public Awareness: Consider issuing warnings to the community about the identified scam patterns to prevent others from falling victim.

- Strengthen Monitoring Systems: Enhance detection algorithms to flag similar activities in the future, aiding in early intervention.

By consolidating all available information and acting promptly, you can significantly advance your investigation into the crypto scam and contribute to broader efforts to secure the cryptocurrency ecosystem.